Creating a will or trust can be a laborious process. There’s a lot to think through: who gets what, when they get it, and how that happens. And there is a ton of related paperwork.

You must keep these documents in a safe place, be sure you don’t lose them, and make sure your executor can get access in case of an emergency. There’s a lot to do.

Failing to Keep Your Affairs in Order

After you set up your will or trust, you’ll likely update your beneficiary forms (i.e. who gets various payouts when you pass) and account ownership. You might have a life insurance policy or business papers, along with deeds for real estate. All of this together is called an estate plan, and you should keep it all in one place.

Your will or trust should obviously be stored somewhere safe, but it needs to be accessible. Those two things don’t always go together, and you’d be surprised how often people misplace at least one document from the estate plan or don’t keep everything together. If you don’t store your estate plan correctly, your family will have a real mess on their hands. And it is possible even your best laid plans will not be carried out the way you want.

After 25 years of practicing estate planning law, I’ve seen just about every messed up situation you can imagine. Sadly, most problems can be avoided by simply organizing your papers in one place, and occasionally, even just every couple years, looking things over.

Getting it right starts with finding the right place to keep things.

Where to Store a Will or Trust Safely

The best place to store your estate planning documents safely is actually a combination of places: we recommend putting your original hardcopy in a fireproof box or safe and uploading a digital copy to an encrypted online vault.

For fireproof boxes, we recommend Sentry, and for encrypted online vaults, we recommend LawSafe® since we designed it for this exact reason.

This combination of places ensures you have the originals when needed and that everything is accessible in an emergency and from anywhere.

That’s the short version. You will hear a lot of similar advice floating around that doesn’t tell you exactly what to do, and that’s because there isn’t one perfect answer. It depends on the nature of your assets, family dynamics, your lifestyle, and unique circumstances.

That being said, there are common goals your choice should orient around. These include:

- Ease of access during your lifetime, in an emergency, and after death.

- Being secure from physical harm and online attacks.

- Having room to store other important documents, checklists and the like.

- Enabling you to update things as life events evolve and your needs change.

That criteria is why we recommend a combination of places, and we’re going to expand on that fireproof box/safe + online storage recommendation first.

After that, we’ll go through the pros and cons of each common method in case you are interested in trying something else.

The Exact Way We Recommend Storing Your Will

Here’s how we recommend storing your will, step-by-step:

- Store your original hard copy in a fireproof box/safe in your home or office. In your basement, off the floor and away from the furnace may be a good location. Or upstairs in your bedroom closet unless you’re adjacent to the kitchen stove, is a good option too. You should consider keeping the important papers and information separate from, say, your safe that might contain jewelry or cash. The reason is if there is an emergency, the only thing your power of attorney needs is the documents and you probably don’t want them rummaging through your stuff. A safe is fine but may not be necessary. Fireproof boxes are inexpensive and perfectly suited to store “all things emergency.”

- Let your power of attorney and/or executor know where your box/safe is. If the lock box has a key or combination, be sure you keep it somewhere your family might find it.

- Set up a secure cloud storage account and upload your digital copy there. Ideally, this service will contain copies of all your other important documents and can hold critical checklists and other information so your family knows what to do if anything unexpected happens to you. (Those extra features aren’t common and are exactly why we built LawSafe®. It’s perfect for storing wills and helping families in an emergency.)

- Refresh the fireproof document and online document as needed. Whenever you make a change to your will or trust, or a beneficiary designation, buy a new house or rental property, or move banks, you should get rid of the older copies and lists and replace them with the new. This will ensure there is legally no confusion and that you and your family are working with the most recent items.

- Consider giving your safe to your executor when you are no longer independent. When our mental and physical faculties begin to fade, it’s usually best to start handing over some responsibility to our loved ones. The irony is that when the time comes to hand things over you will be least able to carry out that task. That is part of the reason we like online vault services, it enables your family to step in but only when it becomes necessary. Be sure to use an online service with a gatekeeper that you can trust, more on that below.

That’s how we tell our clients to do it. That wouldn’t have been our answer twenty, even ten years ago, but technology has changed that.

Other Common Places to Keep Your Will

1. A Secure Cabinet in Your Home or Office

LawSafe® Verdict: Highly recommend, but it’s only part of the solution.

Just because it’s obvious doesn’t mean it’s bad. Storing the original hard copy in your home or office is a fine idea, assuming you store it in a secure place (ideally a fireproof box/safe), let trusted people in your life know where it is, and they can easily access it.

Pros:

- Easy to exchange for the newest version of your will

- Free

- Won’t require your attorney or executor to track down anyone else

- Using a fireproof safe means it is less likely to be stolen, lost, or burned.

Cons:

- Cannot be accessed from anywhere.

- It’s up to you to be sure you have included everything.

- Can be discarded by family members with access.

- Can be lost in moves.

2. With Your Estate Planning Lawyer

LawSafe® Verdict: It can’t hurt but might cost you.

Since your estate planning lawyer will have a lot of your documents and be involved with getting your affairs in order, storing your will or trust with him or her can make sense. Although we don’t recommend relying exclusively on your lawyer, if you have one.

Pros:

- They will at least have the version of your stuff from the time you did your will or trust.

- They can be a good gatekeeper to your documents, even if they are dated, and will be sure to give them to the right person when the time comes.

- Your estate planning lawyer is someone who understands the process and what needs to get done.

Cons:

- Lawyers charge a fee for almost everything.

- If your lawyer dies or retires you don’t have a back up plan.

- It is just about impossible to keep things updated unless the lawyer shares an online vault with you.

- Your family might not want to work with your lawyer.

3. With Your Executor

LawSafe® Verdict: Sounds good, but don’t do it.

Since your executor is the one who will need your will after you pass anyway, why not share it with them, right?

Pros:

- They will have to deal with everything anyway.

- You have chosen them because they are responsible and trustworthy.

Cons:

- You will have to reach out to them every time you update it.

- It can be a burden on executors to have to care for such an important document for years.

- Your executor has his/her own life and you would be surprised how many times executors lose things.

- If you change executors over the years, and that is very likely to happen, you may have a personally confrontational situation to get the papers back, or at least be at risk for insulting that person.

4. With the Local Probate Court

LawSafe® Verdict: Don’t recommend.

If your will has to go to the probate court when you pass, why not store it at the court itself? While this can seem like a good idea, you’re putting your will in the hands of a bureaucracy, which can have some intense limitations.

Pros:

- Can be recorded in public record — ensuring its legal legitimacy.

- If you are concerned a family member will attempt to defraud you, this may be a smart move.

- Will already be in the hands of the probate court when you pass, so in some cases it can’t hurt.

Cons:

- Very difficult to get access.

- Makes updating your will an annoying and costly process.

- This is not a private option — anyone can see your will.

5. Online in a Secure Cloud

LawSafe® Verdict: Highly recommend– a complete solution.

In the early days of the internet, we wouldn’t have told you to place a digital copy of your will anywhere online. But times have changed. Modern encryption and SaaS options make online storage the best option — even a necessary option.

Pros:

- Retains a copy even if you lose your computer.

- Easily updated with the latest version.

- Easy to share exactly what you want only with trusted people.

- Great for your digital back-ups and document organization.

- Some services can also handle some of the critical communication that needs to happen after you pass (e.g. sharing documents, checklists and information only with relevant parties).

Cons:

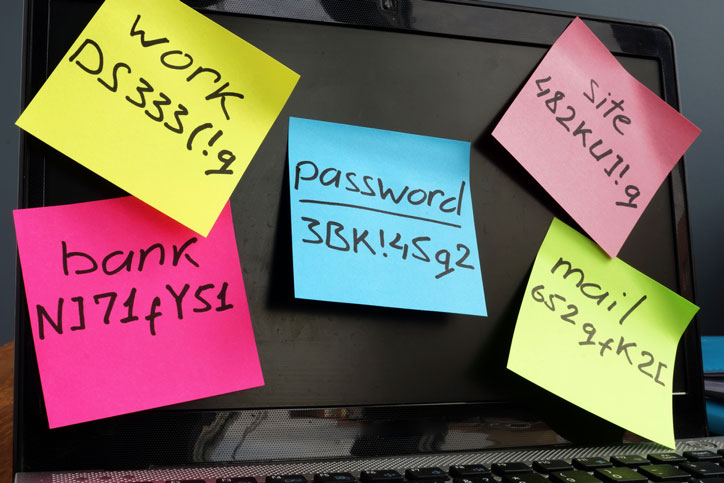

- Nothing on the internet is 100% secure so you should not put account numbers, passwords, dates of birth and social security numbers into any online system.

- Must do your research to find the right platform.

- There are costs involved.

We built the ideal storage system for wills, trusts and estate planning documents. It makes everything involved with getting your affairs in order an absolute breeze — check it out.

6. A Safety Deposit Box

LawSafe® Verdict: Don’t recommend.

Safety deposit boxes are old school but still have their uses in some cases. When it comes to wills, though, we recommend avoiding them since they often slow down the entire process.

Pros:

- No one can open it but you and who you specifically designate.

- Is outside of your home and safer.

- Good for small and valuable items like jewelry.

Cons:

- Even if you give your executor the right to open your box, courts can take a while to approve the request. This slows down any inheritance reaching your family.

- Impractical to keep up to date.

- Have to pay the bank to store it.

- Can’t access after bank hours nor on most weekends.

You’ve Got Options, so Choose Wisely

Secure software designed to make storing your will and other sensitive documents easy

A few years ago, we looked around and noticed that with all of the modern technology and security available to everyone, no one had yet created a good way to store sensitive estate planning documents like wills or trusts. So we did.

LawSafe® is a cost-effective and highly secure way to store your will and all of the other sensitive information and documents you need to organize when getting your affairs in order.

It’s perfect for this process, and here are just a few of the features:

- One encrypted place for all of your relevant documents in pre-set folders with prompts from estate planning lawyers ensuring you don’t forget anything.

- Have your hand-selected Gatekeeper release relevant documents and account information to your predetermined “Circle of Trust®” in case of an emergency.

- Your Circle of Trust® includes your power of attorney and executor. You should have a back up, and LawSafe® enables you to include them all.

- Update, print, and share any documents in seconds. Same with your information and checklists, there is a customized place for everything so you don’t forget anything.

- Specially designed by estate planning experts with decades of real life experience so your family will have everything they need to get the job done.

Give your family peace of mind and get your affairs in order with the most modern and easy-to-use software available — LawSafe®.

Your family will thank you.